Wages (Pay as you earn)

19. Jul 2024

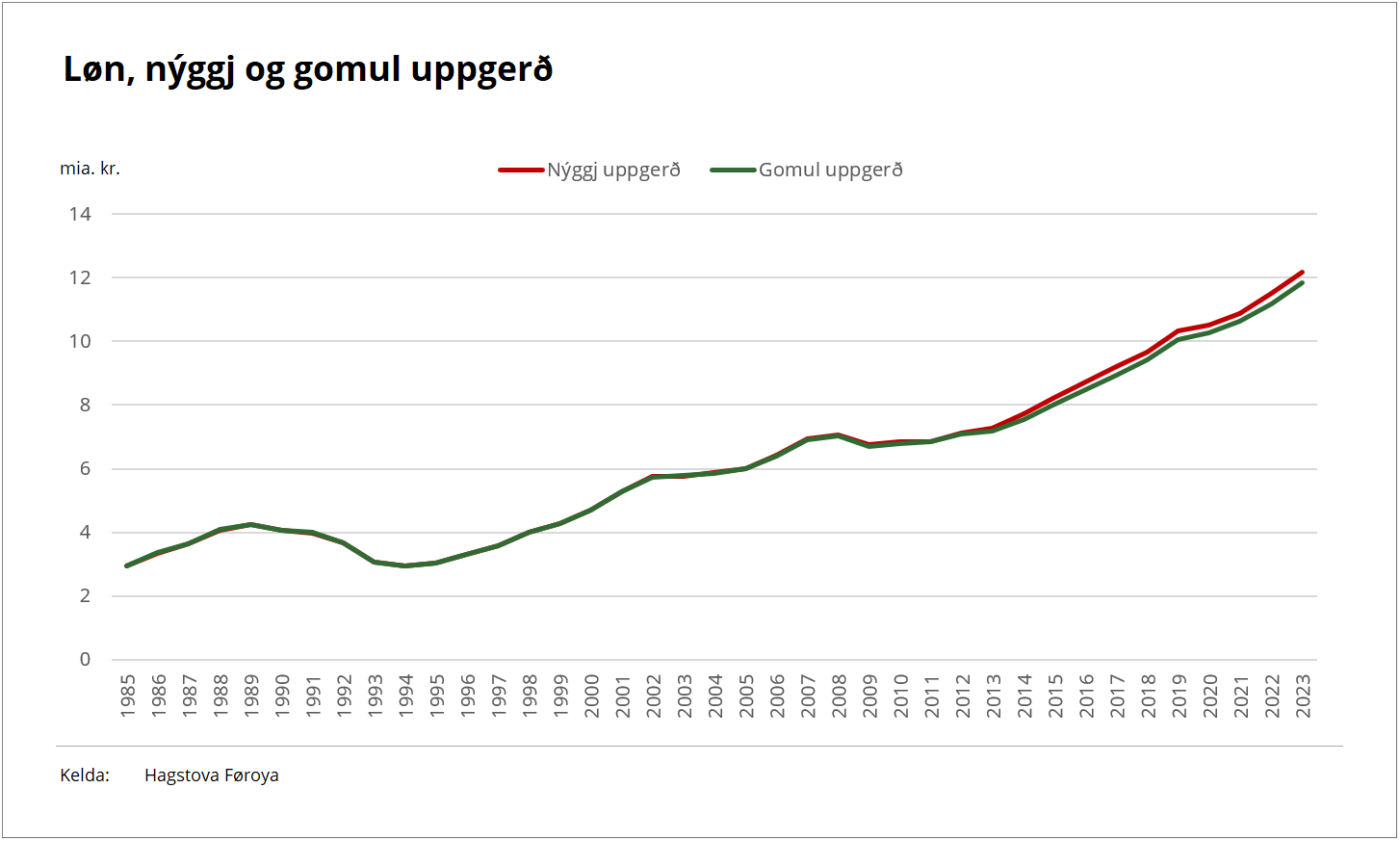

Wages taxed at source rise 5.8%

Revised statistics on wages subject to tax at source (known as A-income in the Faroes – referred to as ‘A-taxable wages’ in this article).

Statistics on A-taxable wages have been updated and published anew. The revised methodology provides more granular data, allowing for a more detailed analysis of wage trends. This brings with it certain changes in the statistics – for details, see the box at the bottom of this article.

The vast majority of wages in the Faroes are classified as A-taxable wages, i.e. they are taxed immediately upon payment through tax authority TAKS’s pay-as-you-earn (PAYE) system. The PAYE system thus gives a good indication of the wage trend in the Faroes.

The trend shows that wage payments declined at the onset of the Covid-19 pandemic in 2020. The trend then reversed in the second half of 2021, and wages have since seen fairly steady growth. DKK 12.4 billion was paid in A-taxable wages from July 2023 to June 2024. This is an increase of about DKK 700 million (5.8%) compared with the previous 12-month period.

[px-graph-1]

Women lead wage growth

Women’s wage growth has been relatively steady in recent years, while men's wage growth was more affected when the pandemic hit.

[px-graph-2]

Men accounted for about 60% and women 40% of wages in the past year. However, women’s wages increased more – up 7.7% year-on-year, compared to 4.6% for men.

[px-graph-4]

Wages by industry

Part of the revision of the statistics on A-taxable wages is that the industry classification follows Eurostat's NACE Rev 2.0 industry classification. The new industry classification is now more detailed and internationally comparable. The table below shows the A-taxable wages at the first level of the new industry classification.

[px-graph-3]

More detailed industry statistics are available in the statbank here.

About the wage statistics

Wages as a statistical concept are part of the broader definition of compensation for employees. Compensation is divided into a) wages and b) employers' contributions to social schemes, including pensions. The terms are based on the description in the national accounting manuals 'System of national accounts' published by the UN and 'European system of accounts' published by Eurostat.

According to this definition, wages include wage components such as basic wages, allowances, overtime pay, holiday pay and employee benefits. Not included are employer social benefits such as pensions, unemployment insurance and maternity benefits.

The wage statistics only include cash wages paid by employers to employees through the PAYE system. The wage statistics thus cover A-taxable wages from employers who are economically active in the Faroe Islands. All wage payments that meet the above requirements are included, regardless of whether the employee resides in the Faroes or abroad.

Updates to wage statistics

The wage statistics system was revised in the first half of 2024. Key updates include:

- Mean and median wage figures are calculated based on employees' total wages. These figures can also be broken down by municipality of residence, industry, or sector.

- Main industry according to NACE Rev. 2 (2008). The wage statistics are restructured to comply with the internationally comparable classification NACE rev. 2. (2008). Levels 1 and 2 of the classification are directly comparable. In level 3, some selected sub-industries are further divided to accommodate special Faroese conditions. The main industry is the industry in which the employer has the most activity.

- Sectors. Wage figures can now be classified according to whether the employer is under public or private control. The sector classification is based on the international classification in Eurostat’s ‘European system of accounts’. The sectoral division in the statbank is a simpler configuration of this classification.

- Employees’ citizenships are further broken down into regions and continents.

- Residency status, showing wage trends of individuals with or without long-term residency status.

- Municipality of residence, showing wage trends based on the employee’s municipality of residence.

Employees’ main or secondary occupation. This feature makes it possible to see how much is paid in wages where the employee earns the highest wage.

Revised statistics

Wage statistics have been updated and revised. These changes have led to a slight increase in total wages, particularly in recent years. For 2023, about DKK 300 million have been added to total wages paid, bringing the total to DKK 12.2 billion in 2023. This increase is due to the inclusion of employers registered in the Faroese International Shipping Register (FAS), who are now considered part of the Faroese economy. Another change is that that certain payments via the PAYE system, previously not considered wages, are now correctly recorded as wages. Most of these payments were previously registered as public benefits. Due to these changes, the latest figures cannot be compared to previous data. Older tables are still accessible in the statbank but will not be updated. These tables are labelled 'Outdated' in the statbank.