Economic sentiment indicator

07. Feb 2022

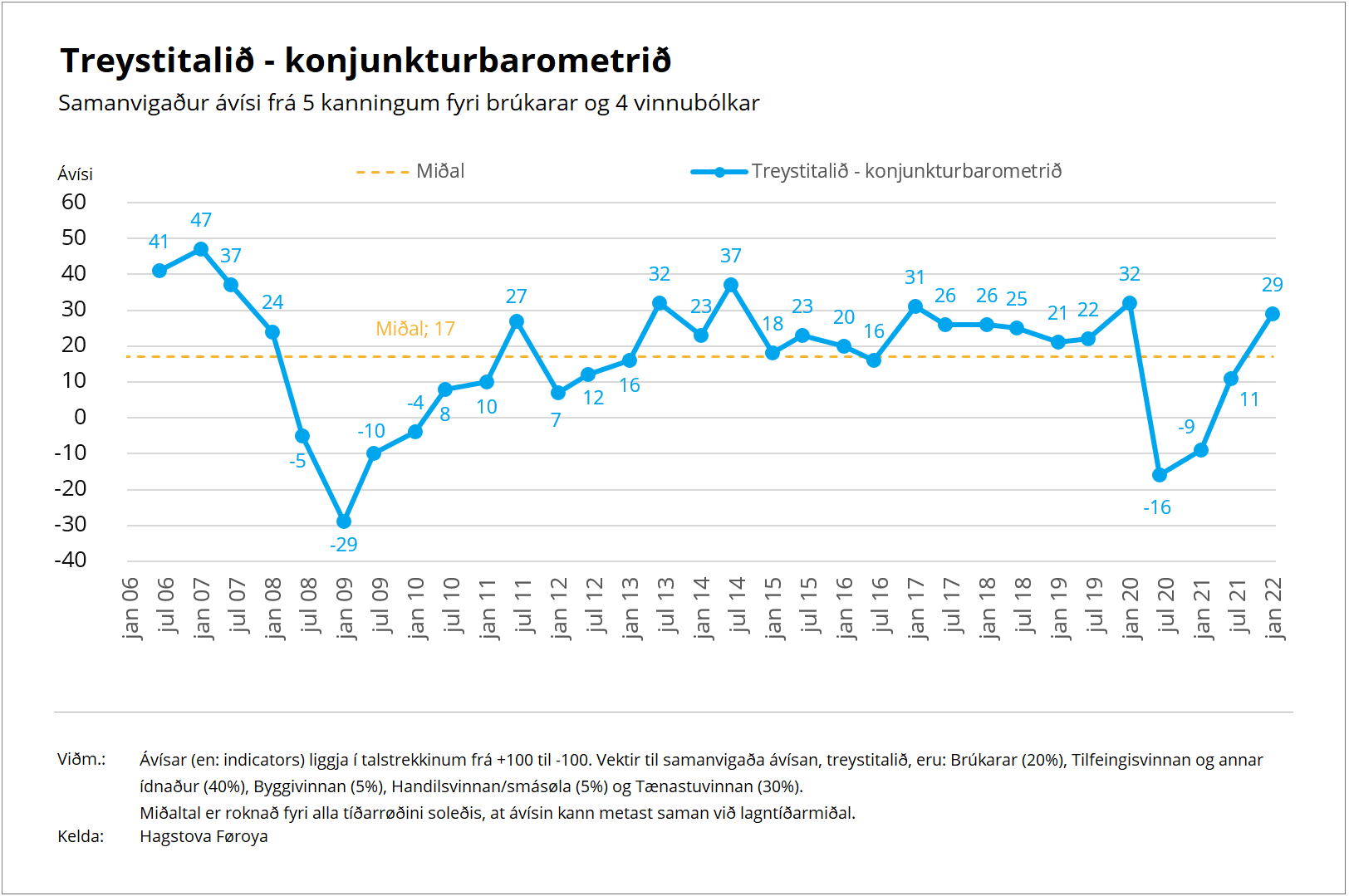

Business and consumer confidence back to pre-Covid levels

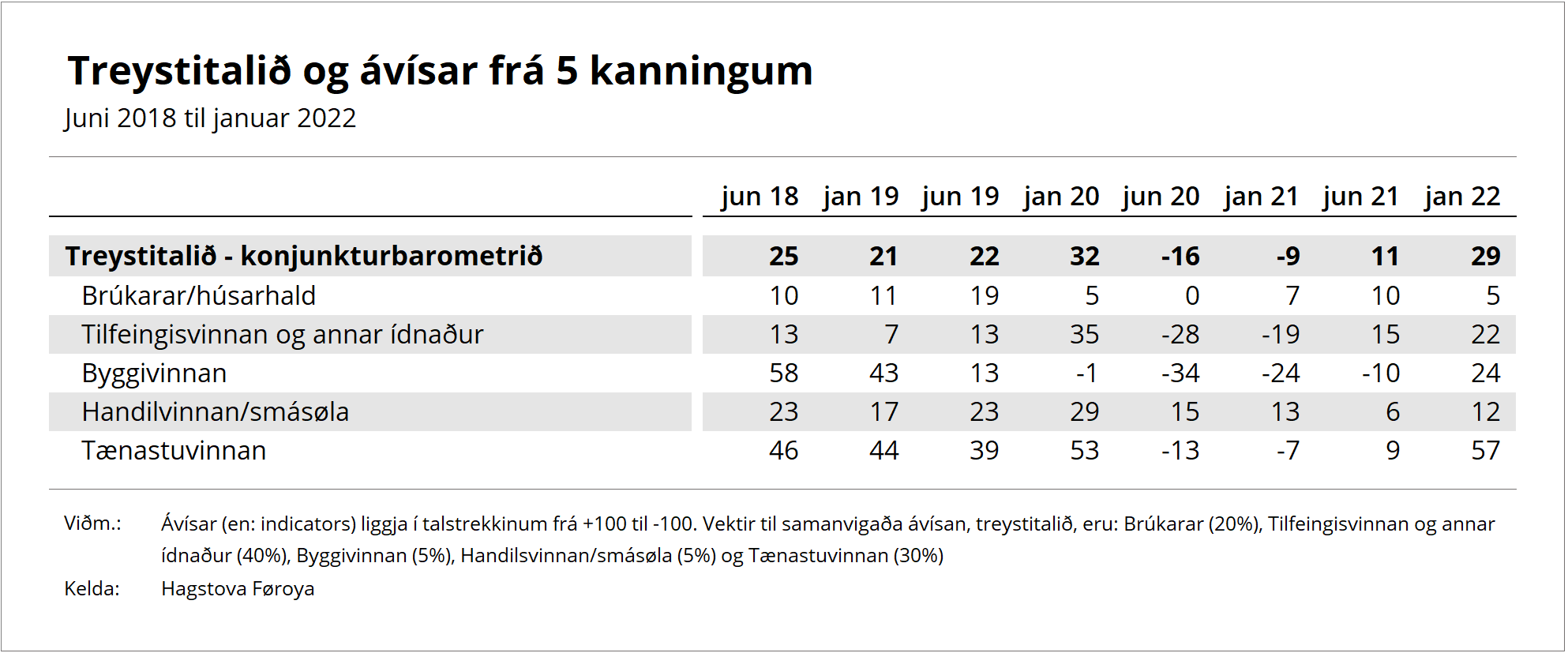

Statistics Faroe Islands has just conducted the five biannual surveys gathering the views of households and the four industrial sectors on the current and expected economic condition. These five surveys make up the Economic Sentiment Indicator (ESI).

Prior to the Covid-19 outbreak two years ago, the ESI was in a stabile position before dropping dramatically from 32 to minus 16 in the surveys of the summer 2020, which marked the biggest decline since the surveys were first conducted in 2006. Since then, the ESI has steadily risen for each survey and is now at 29, which is roughly the same in comparison with the figure before the pandemic.

The economic sentiment indicator is an arithmetic mean of the confidence indicators extracted from the separate conducted surveys. The latest survey results show that the confidence indicator for the ‘services’ and ‘construction’ industrial sectors saw the biggest increase, while a smaller increase is recorded for the industrial sectores ‘primary sector and industry’ and ‘retail trade’. The confidence indicator for households is 5 compared to 10 in the summer of 2021.

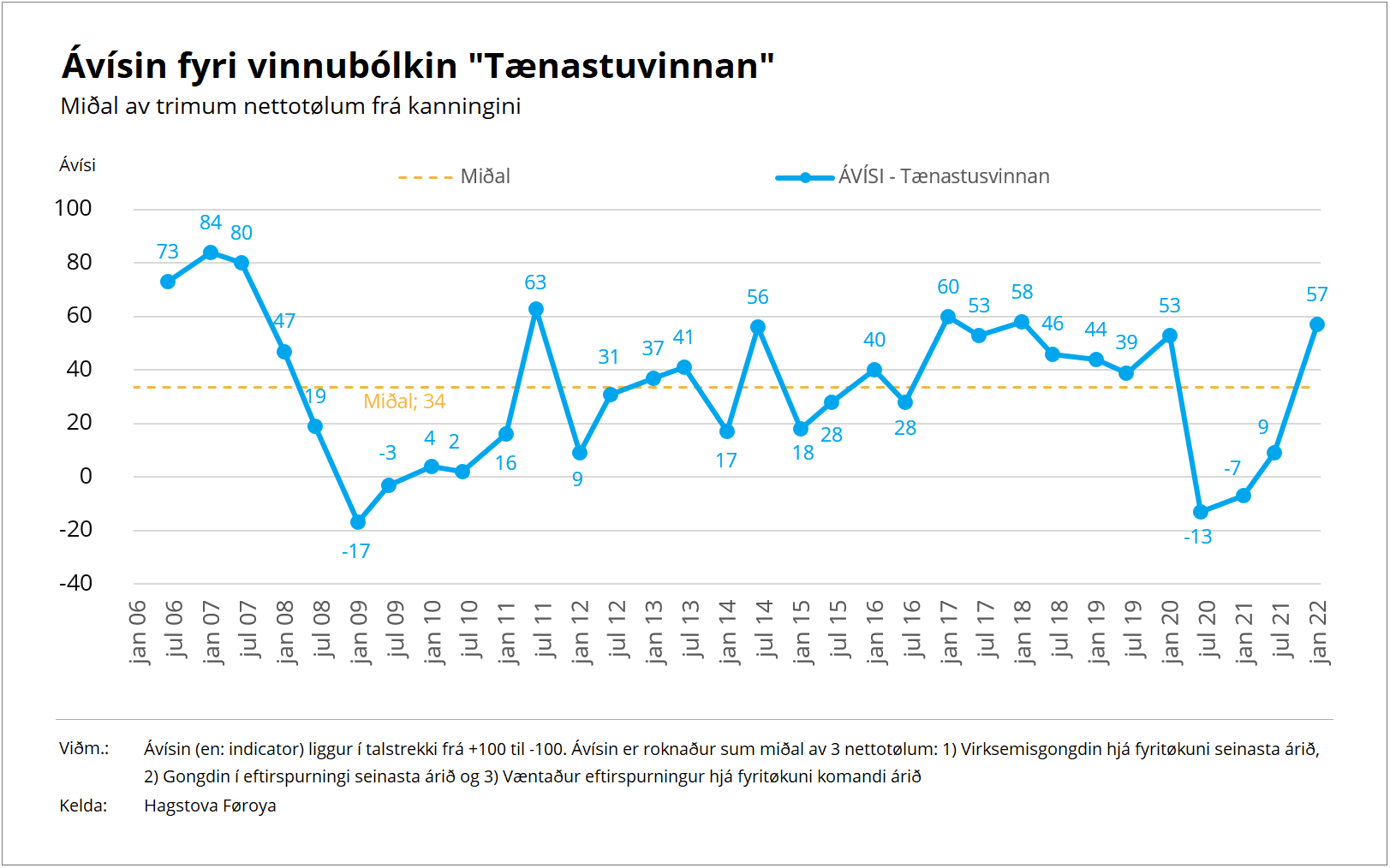

The services sector industrial sector

The ‘services’ industrial sector, which includes restaurants, hotels and road hauliers, was hit hard by the effects of Covid-19.

After the pandemic hit two years ago, the confidence indicator for ‘services’ dropped by 66 points in the first half of 2020, which is the biggest decrease between back-to-back surveys since 2006. The confidence indicator then increased somewhat in the following two surveys. In the latest survey, the confidence indicator for ‘services’ was at 57, compared to 9 in the summer of 2021. The latest survey shows that businesses in this group are more optimistic on average about the past year than in the previous three surveys. Asked about expectations for demand for staff in the coming year, a growing number of businesses estimate that the demand for staff will increase. Further information.

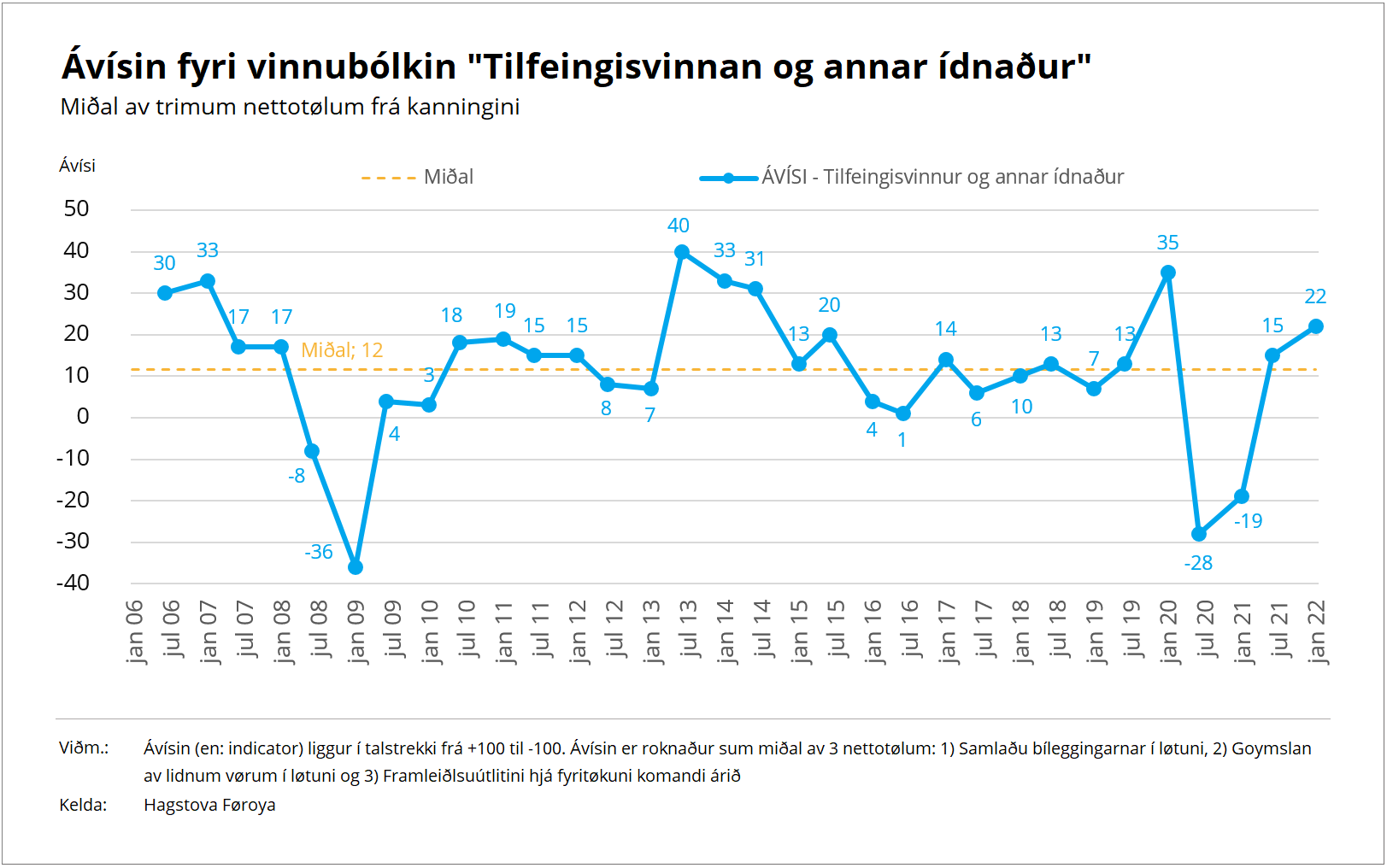

The Primary sector and industry

Fish exporters make up a significant portion of the ’primary sector and industry’ sector.

International fish markets suffered greatly from Covid-19 restrictions, which led to a relatively big drop in exports and overstocked warehouses. As a result, the confidence indicator plummetet as rapidly as ever before since 2006, as was the case for confidence in the ‘services’ industrial sector. The trend has since reversed, now more or less equalling the confidence indicator level from before the pandemic, surpassing the long-term average. As was the case in the last survey in the summer of 2021, in the latest survey a small majority of businesses within this sector are optimistic, estimating that as of now orders from abroad are more numerous than usual. An even larger majority of businesses than in the previous survey estimate that stock of finished products is too small. A relatively large majority of businesses also estimate that orders for the coming year are larger than usual. Asked how much guaranteed work is anticipated by number of months, the answer was 6 months, which is close to the long-term average in this industrial sector. Further information

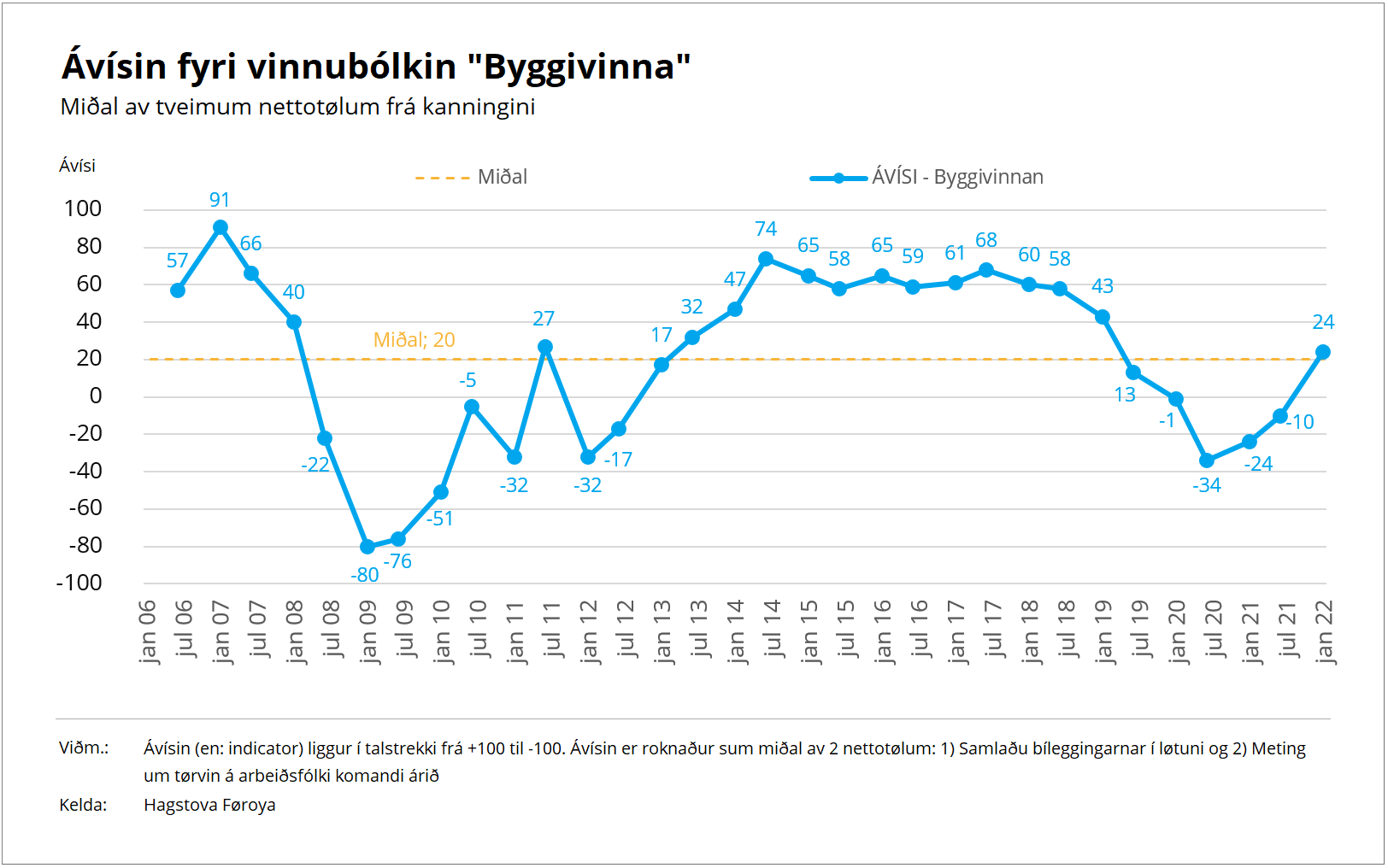

Construction

Following a stable period from 2014 to 2017 in which the confidence indicator remained relatively high, optimism in the ‘construction’ sector dropped from 2018 to the summer of 2020.

In contrast to the ‘primary sector and industry’ and ‘services’ industrial sectors, the confidence indicator for ‘construction’ began declining relatively early, and prior to the Covid-19 outbreak. However, the three most recent surveys have seen a return to a growth in confidence. The average estimate among construction businesses is that for the coming 13 months guaranteed work is expected. This is an increase of two months on the two previous surveys. Further information.

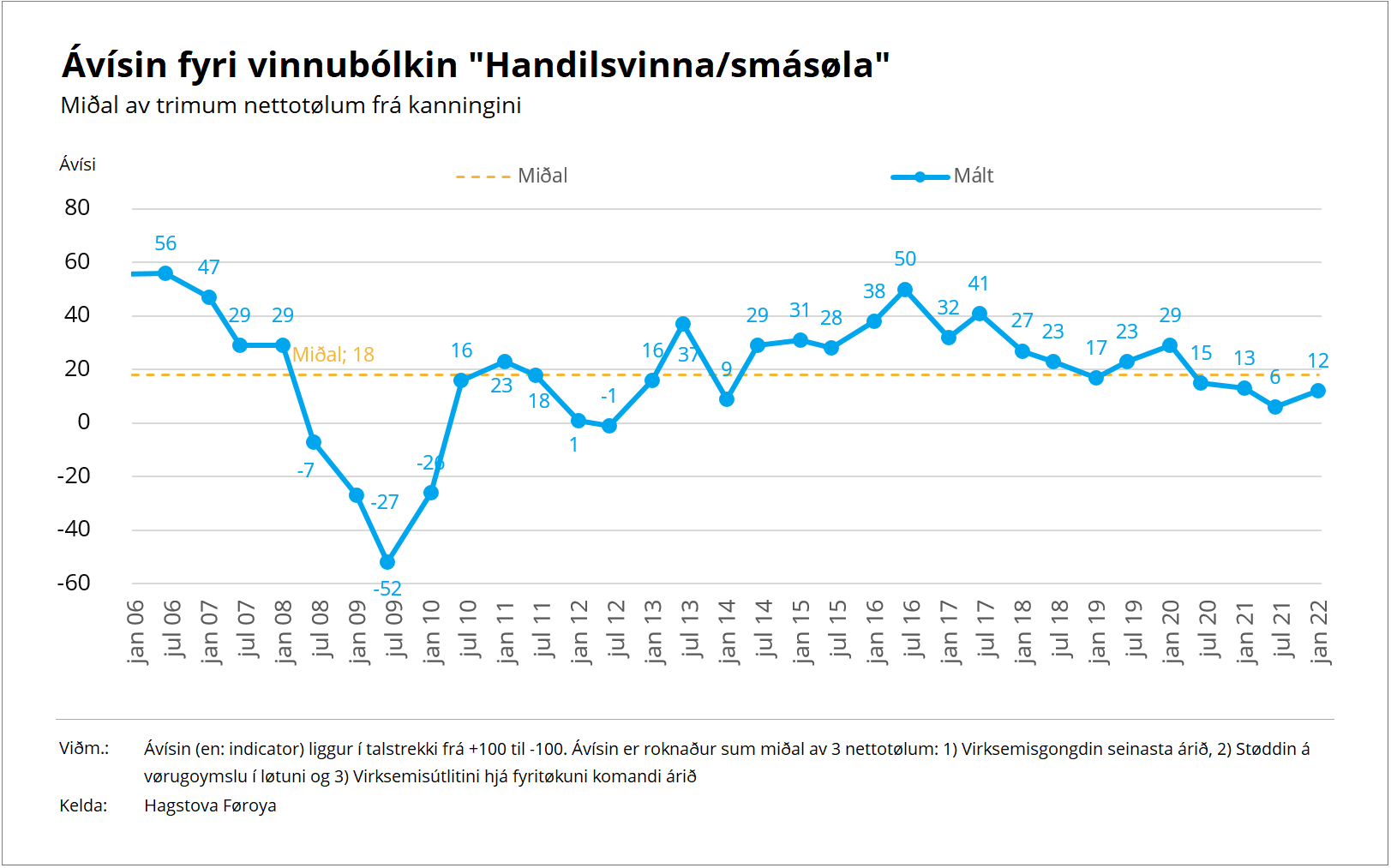

Retail trade

From a long-term perspective, the confidence indicator for the ‘retail trade’ industrial sector has been gradually decreasing since 2016, scoring below average in the previous four surveys.

During the pandemic, however, the confidence indicator for ‘retail trade’ has not declined at the same rate in comparison with the other three industrial sectors. Since 2006 it has been estimated by a majority of retail businesses that warehouse are are either adequately stocked or overstocked, as opposed to understocked. 16% of the retail businesses included in the latest survey estimate that warehouses are currently understocked, which is the highest percentage since 2006. In terms of expectations for sales in the coming year, the responses yielded a net figure of 19, which is just below the total average since 2006. Zero retail businesses expected a decreasing demand for staff in the coming year, corresponding to to a net figure of 32, which is more or less unchanged compared to the survey in the summer of 2021, and above the long-term average. Further information.

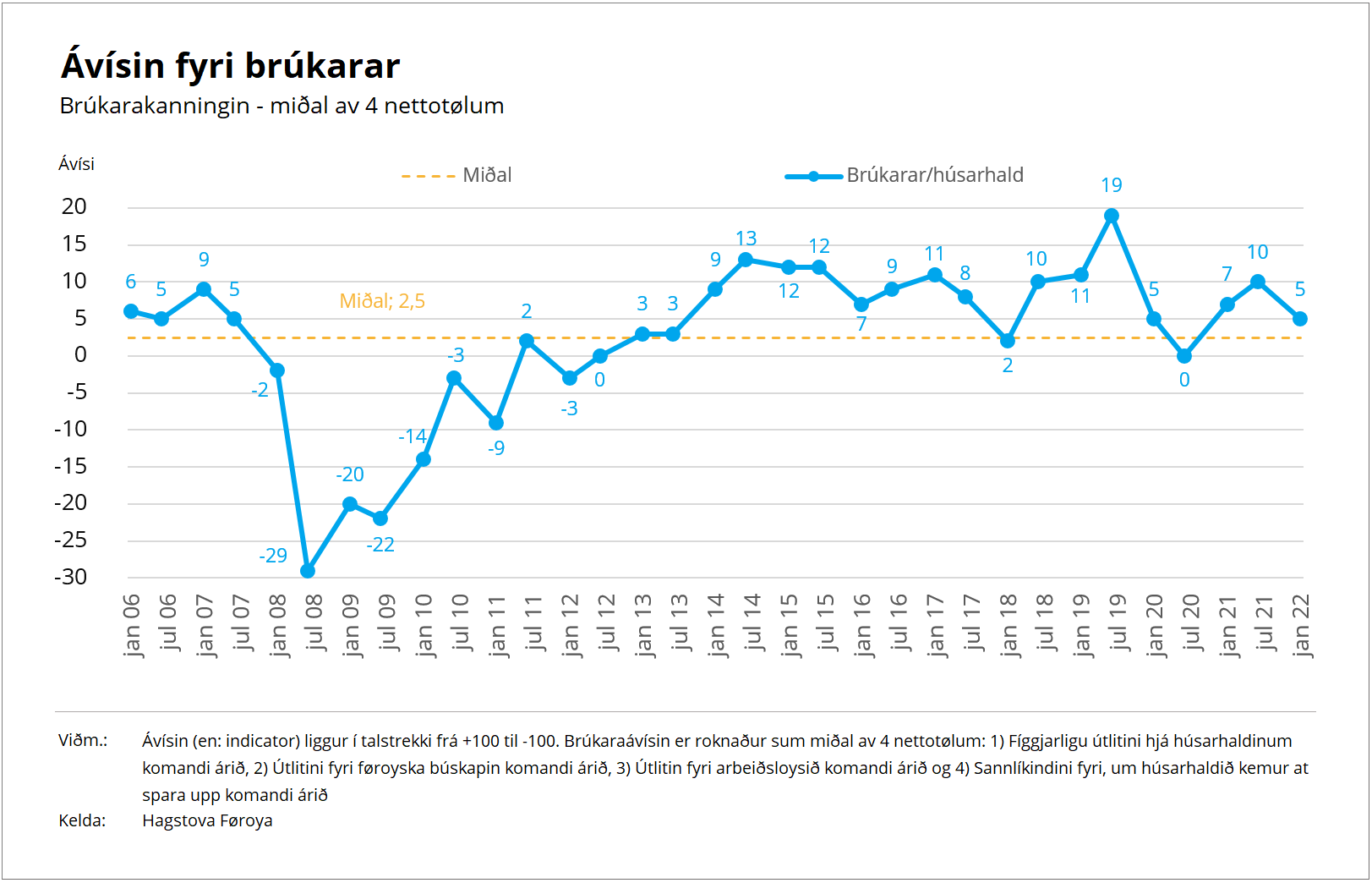

Households

The confidence indicator for households is down by five points, from 10 to 5, since the summer of 2021. However, it remains above the long-term average, as was the case in the two previous surveys.

In terms of the condition of the Faroese economy in the past year, the net figure of the confidence trend for households has been gradually decreasing since the summer of 2019. In terms of the outlook on household economies, the net figure remains more or less unchainged and close to the long-term average. Households noted an average estimate that the Faroese economy will remain in a similar condition as today during the next 12 months, though the net figure in the summer of 2021 was at a more optimistic 8. In the previous six surveys, an increasing portion of households stated that they have plans for home improvements in the coming year. The net figure for this question was 19, which is the highest rate since 2006. Further information.