Economic sentiment indicator

02. Jul 2021

Business and consumer confidence continues to rise

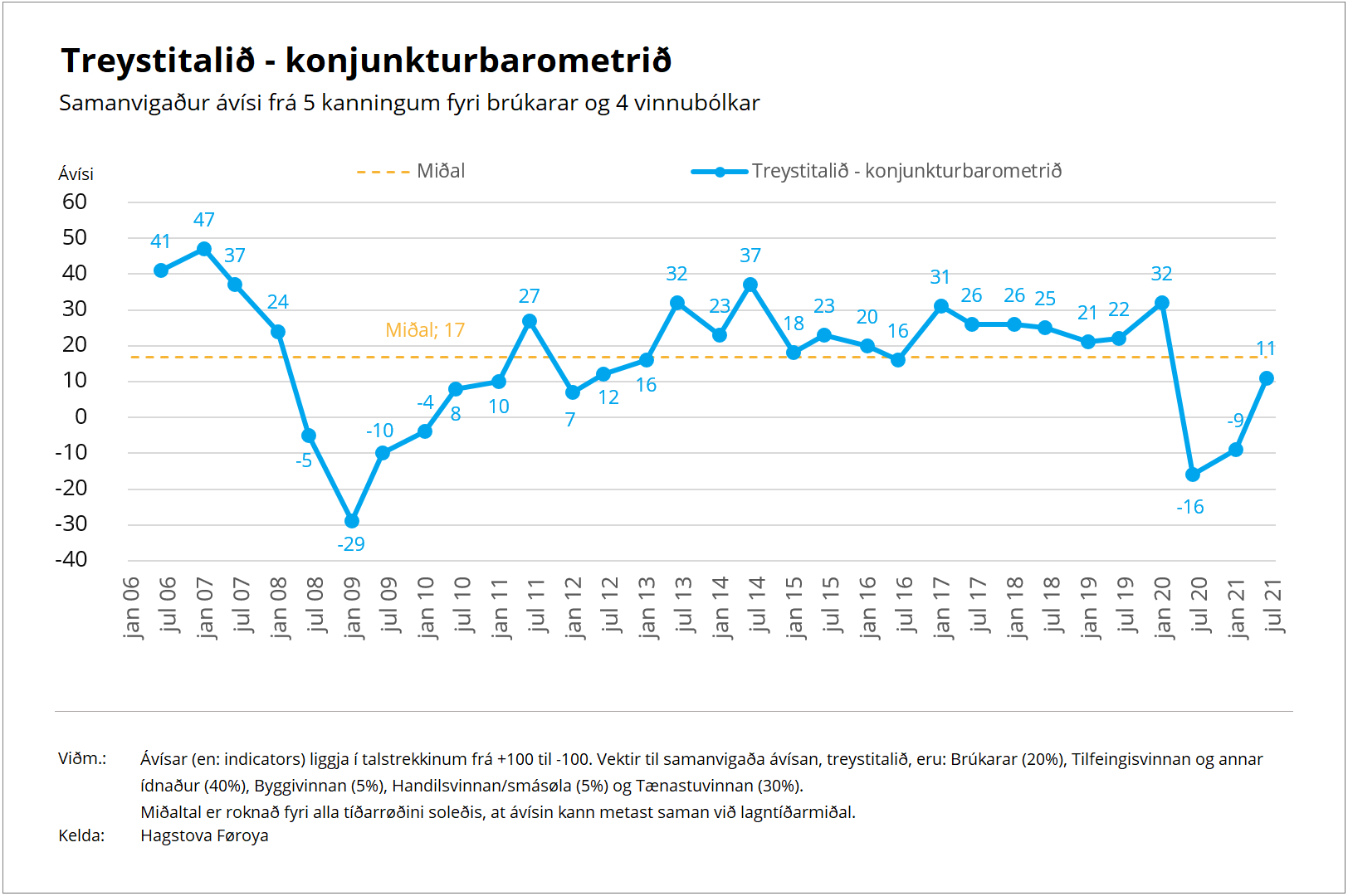

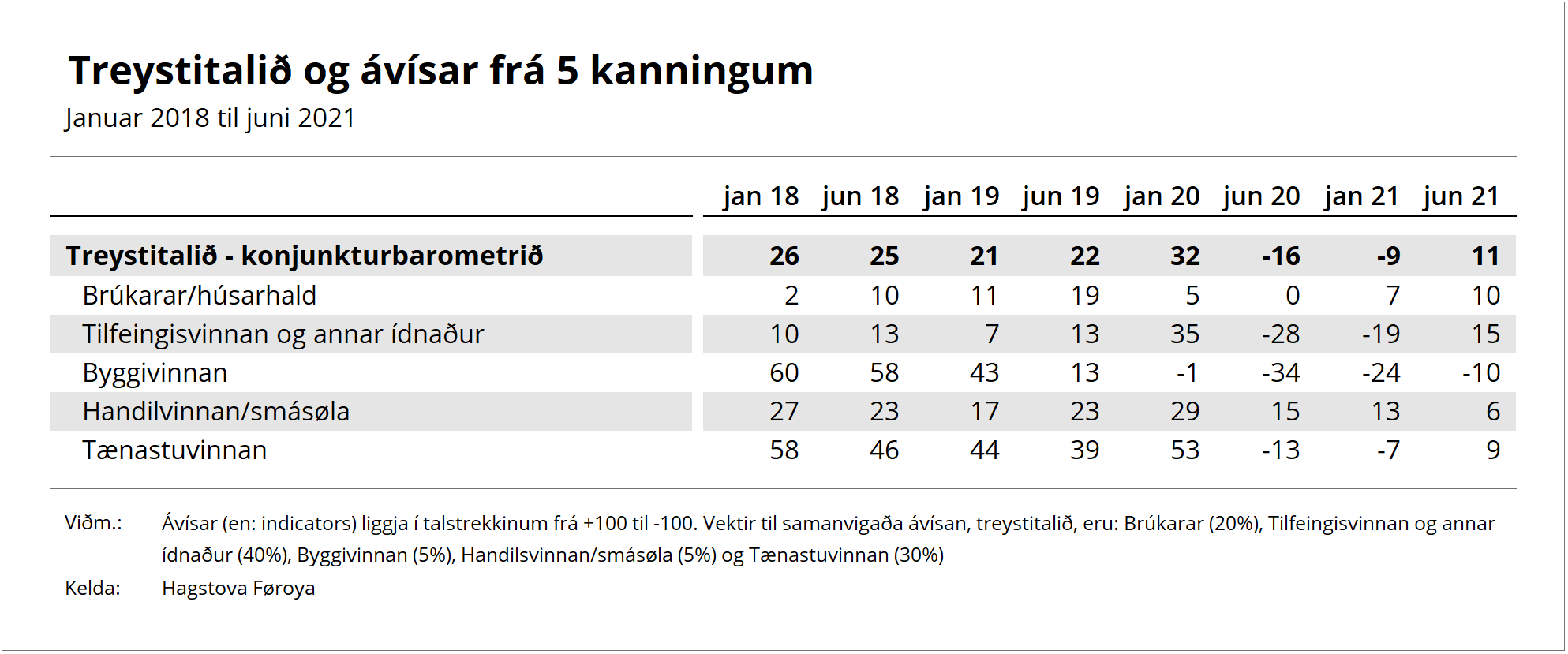

After a lengthy period with relative stability prior to the Covid-19 pandemic, the ESI dropped dramatically last year, from 32 in January to minus 16 in June. The figure rose to plus 9 in January 2021 and reached 11 in June 2021, thus closing in on the long-term average of 17.

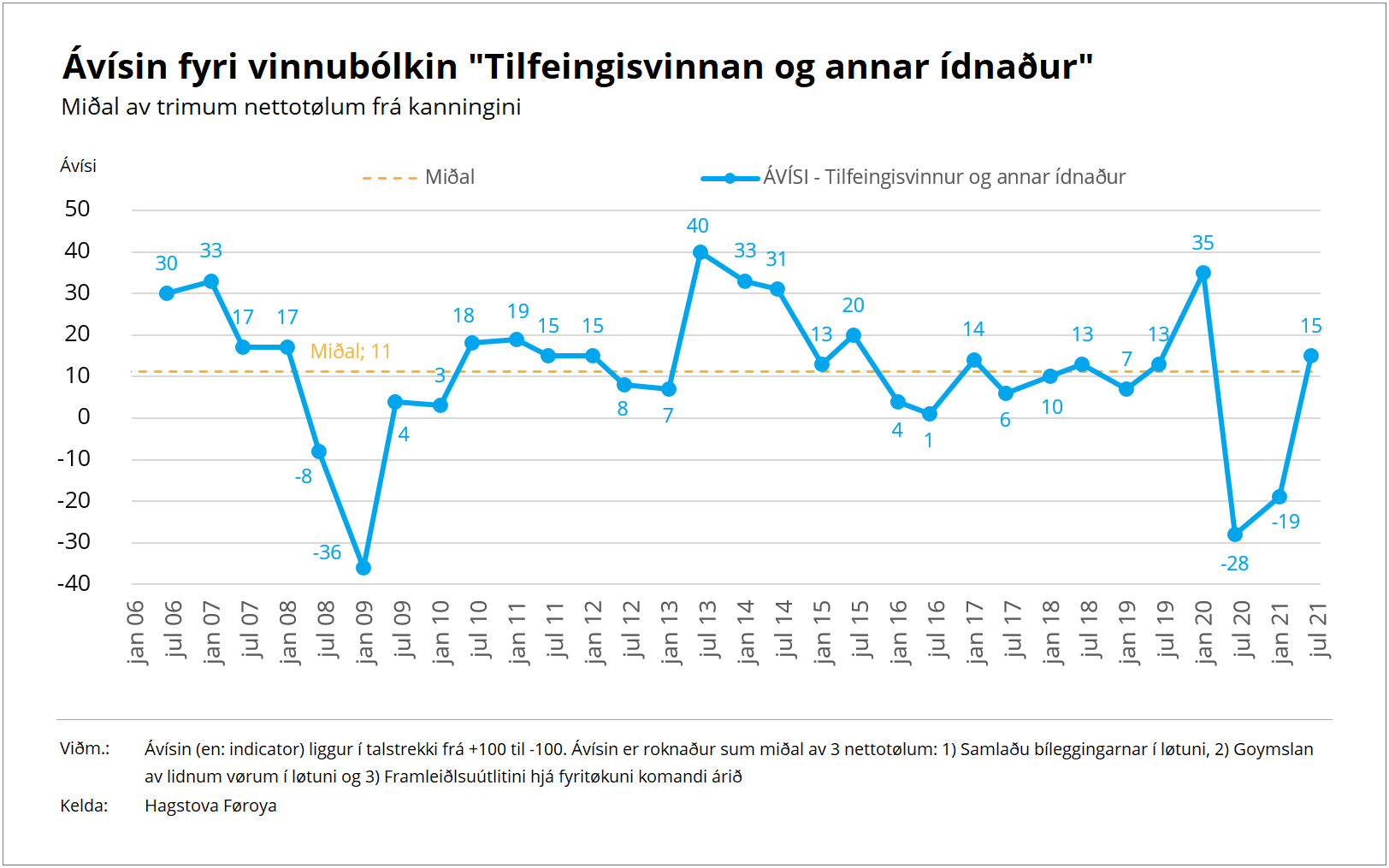

The ’primary sector and industry’ and the ‘services’ industrial sectors have the greatest impact on the ESI, and these are also the sectors which saw the greatest swings during the Covid period.

Fish exporters make up a significant portion of the ’primary sector and industry’ sector. International fish markets suffered greatly from Covid-19 restrictions, which led to a relatively big drop in exports and overstocked warehouses. However, optimism is rebounding, compared to the two previous surveys, with fish exporters expecting more orders from abroad and increased production over the next year.

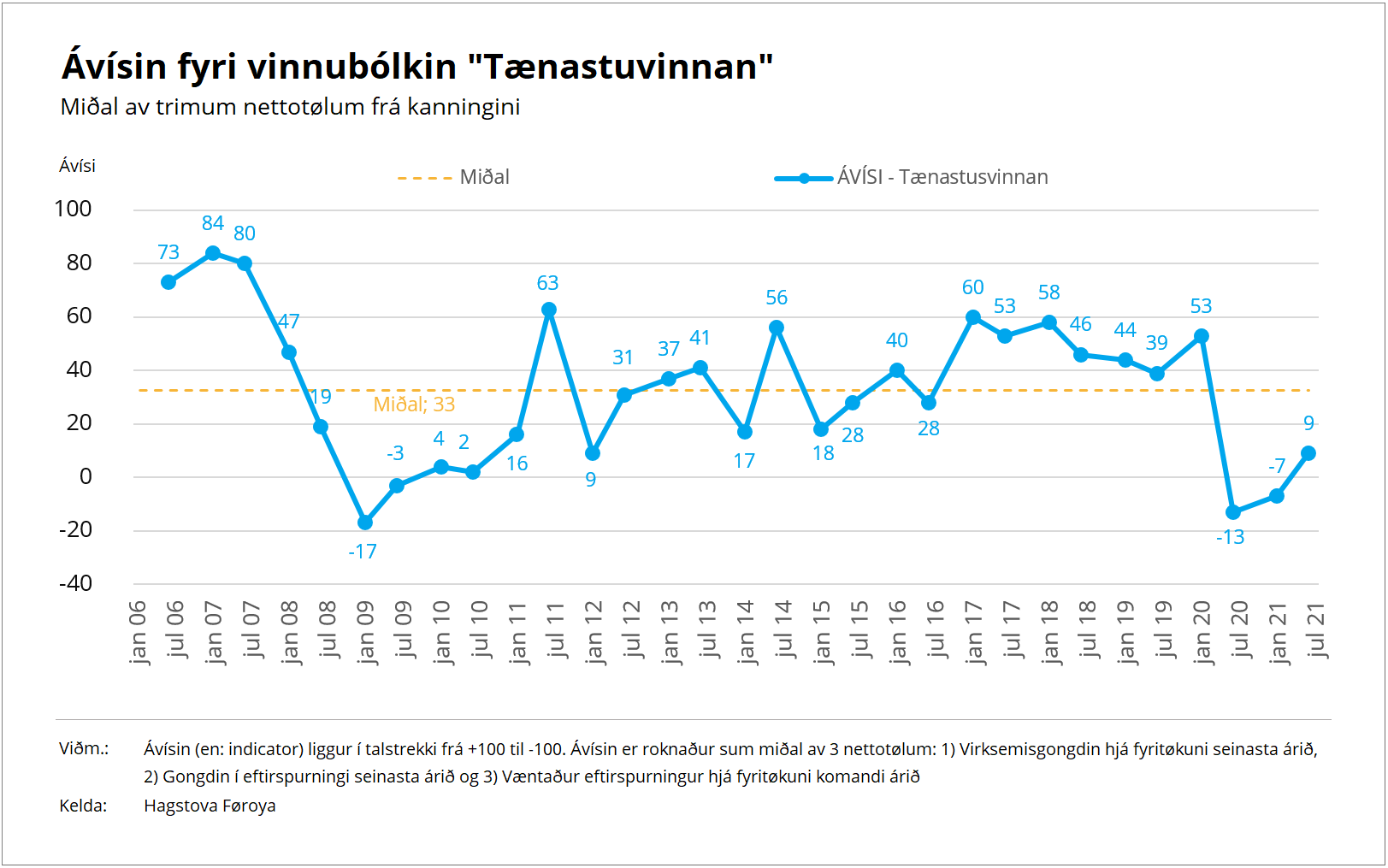

The ‘services’ industrial sector, which includes restaurants, hotels and road hauliers, was hit hardest by the effects of the Covid-19 pandemic. But, compared to the previous two surveys, businesses within this sector are also more optimistic now, expecting staff increases over the coming year.

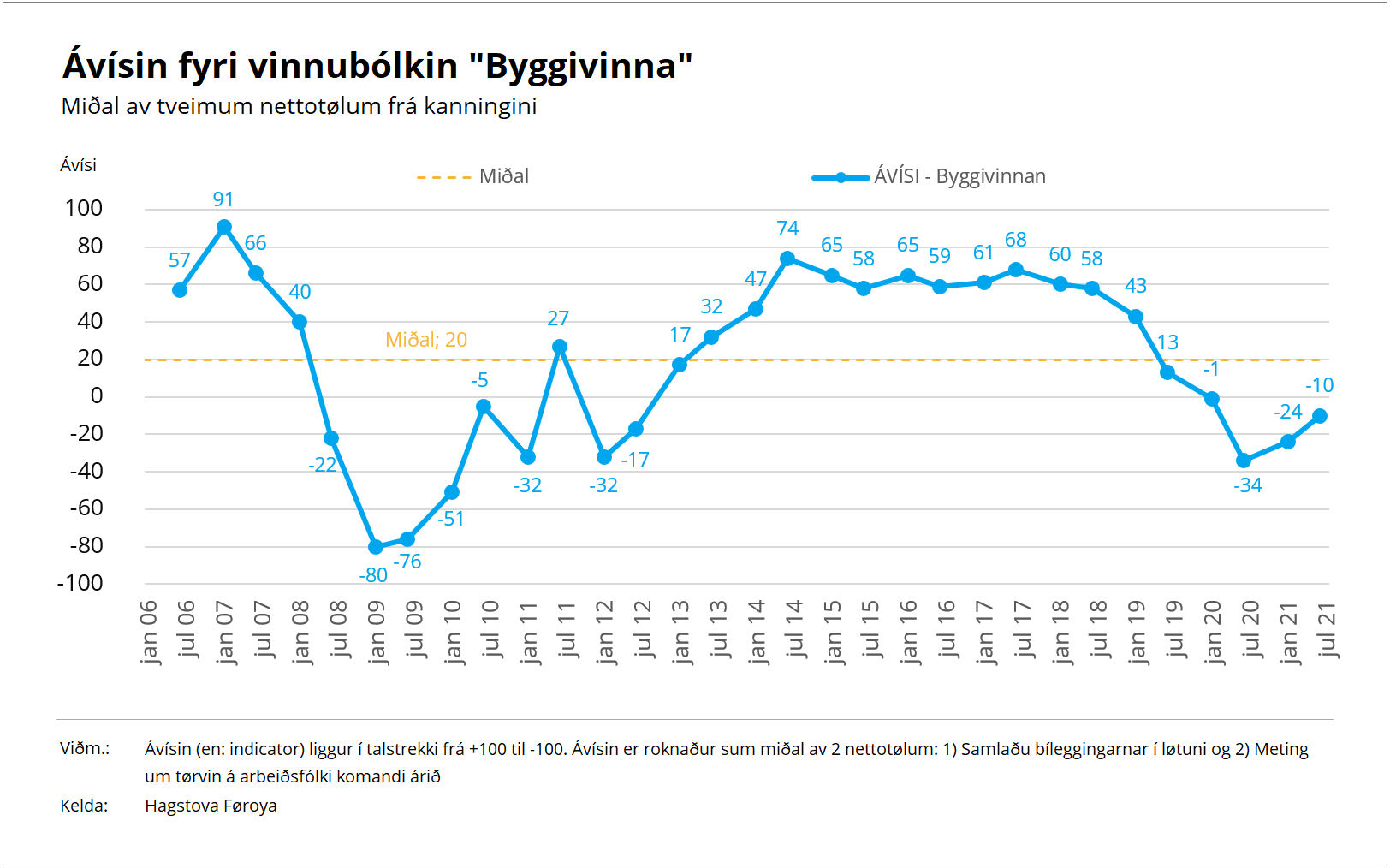

Compared to the ’primary sector and industry’ and the ‘services’ industrial sectors, ‘construction’ fared much better through the pandemic.The confidence indicator for the ‘construction’ industrial sector was declining prior to the pandemic, but it has gone up again in the past two surveys, evidenced by expectations of an increased demand for staff over the next year.

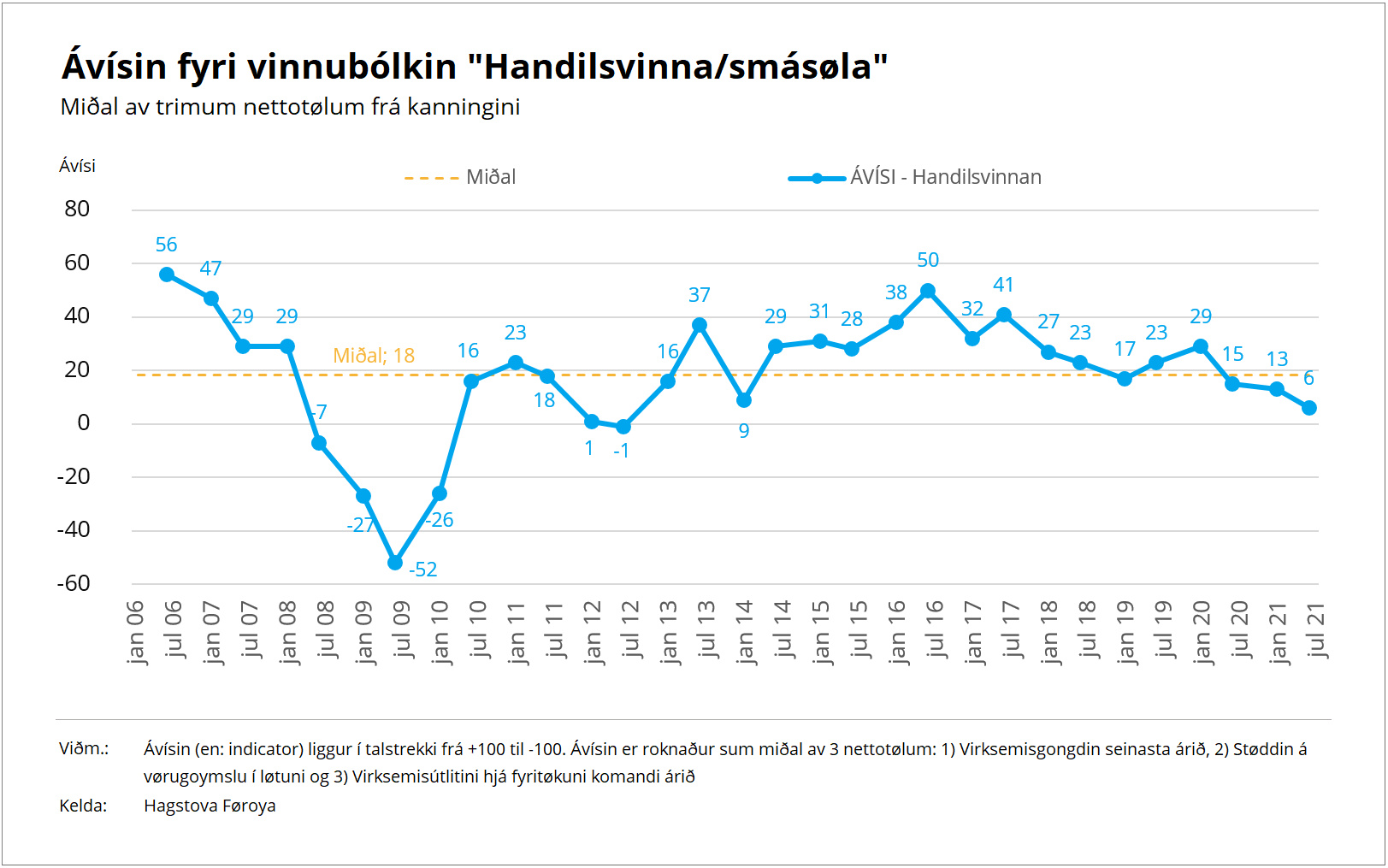

The confidence indicator for the ‘retail trade’ industrial sector is the only to have gone down compared to the two previous surveys. Operators in this sector expect increased sales and a higher demand for staff over the next 12 months.

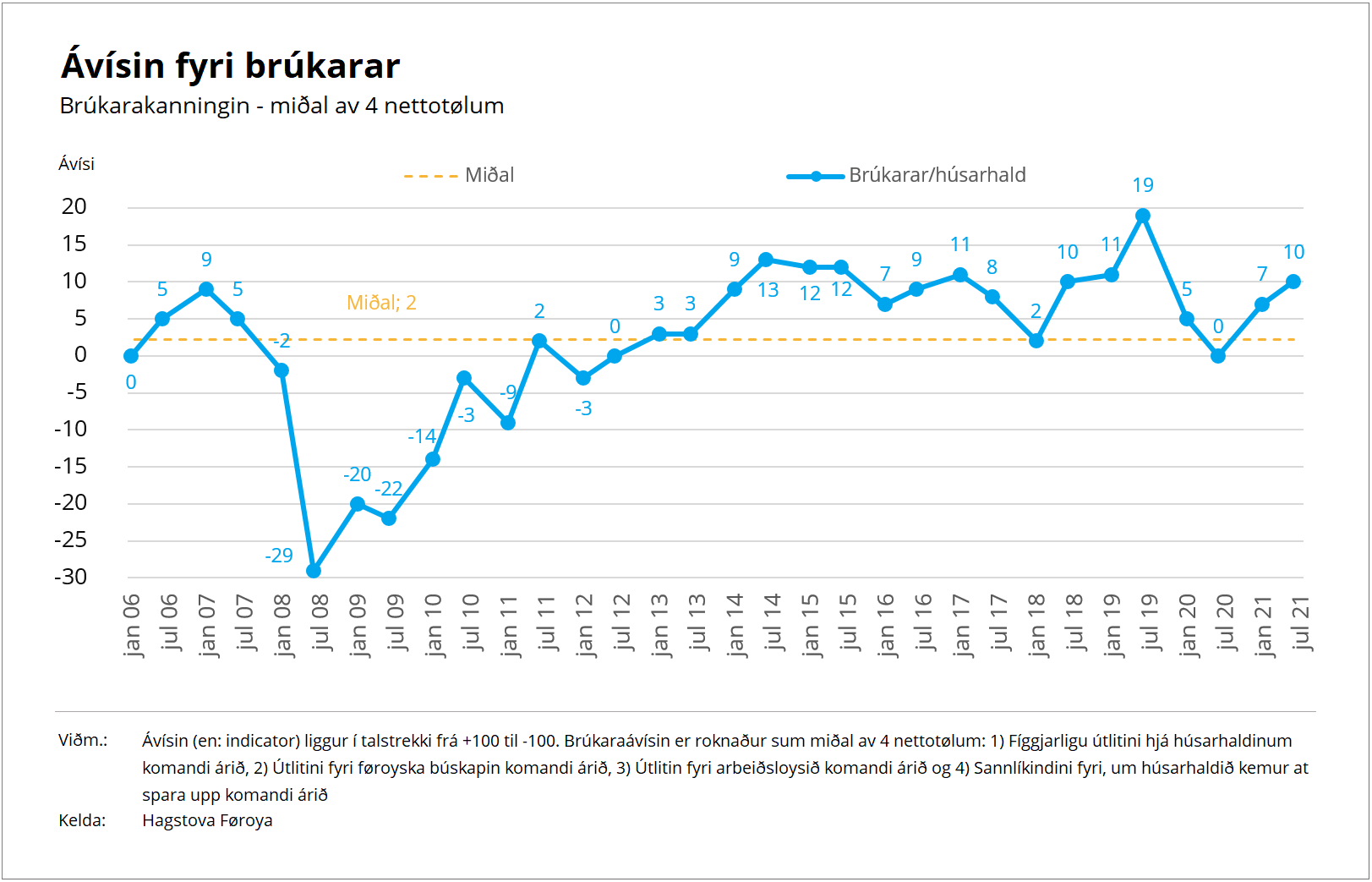

The latest ESI suggests that Faroese consumers have not been greatly affected by the pandemic. The consumer confidence indicator dropped from 19 to 5 in the last survey prior to the Covid-19 outbreak, reached 0 in June 2020 and has now rebounded to 10. Households now have more confidence in the Faroese economy than they did a year ago, and their economic outlook for the next 12 months is brighter than in the previous three surveys.